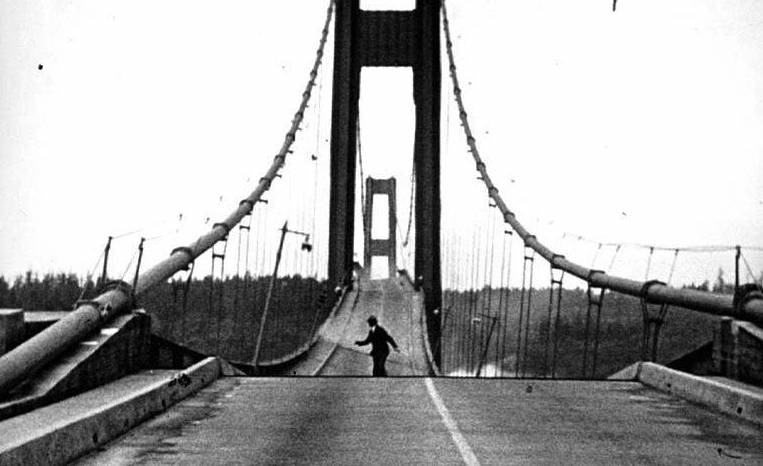

For those that have grown up in the Pacific Northwest, the story of the most famous suspension bridge to be built, and subsequently destroyed, in our own backyard is well known. For the rest of the world the Tacoma Narrows Bridge, more commonly known as Galloping Gertie, is no more than a footnote on a study of failure analysis for a university level structural engineering class.

What is remarkable about Gertie’s destruction is that it happened during the peak of the industrialized era when mammoth projects such as the Grand Coulee damn, Panama Canal, and the Empire State Building were constructed; icons of mankind’s ability to conquer and harness the natural forces. Along with the sinking of the Titanic, the Tacoma Narrows bridge collapse was a sobering reminder of the devastating cost of hubris.

As we are nearing the 75th anniversary (November 7, 1940) of Gertie’s demise, we thought it worthy of a discussion to explore the event as a way of broaching the broader topic of Systems Engineering and how it informs our thinking in how we view the world, and more importantly, manage our clients' assets.

Systems Engineering

Systems Engineering is believed to have come about in the early 40’s at Bell Laboratories when they realized that traditional methods of iterative design were increasingly ineffective as the projects became larger and more complex. Systems design and modeling techniques were developed to bring about new tools and ways of solving these bigger problems. NASA studied systems engineering extensively and successfully applied it to the Apollo space program and subsequent programs. A study by NASA in 2005 illustrated the benefit of implementing Systems Engineering, demonstrating substantial improvement in mitigating cost overruns.

In the case of Galloping Gertie, it is highly likely that application of the Systems Engineering would have revealed the now obvious blind spot overlooked by the designers of the Tacoma Narrows bridge – the effect of gale force winds on the suspension design and the subsequent oscillation that lead to collapse. We believe there is a powerful lesson to be learned from Gertie’s destruction that applies directly to how investors view the markets and either prepare for the unexpected, or fall victim to the design flaw leading to repeated cyclical devaluations in their portfolios.

Application to Managing Your Wealth

Our philosophy is increasingly drawn to the framework that Systems Engineering provides both identifying and focusing on the elements that comprise a robust and integrated portfolio management system. The essence of Systems Engineering is the application of The SIMILAR Process, an acronym for the process steps of implementing systems engineering:

Similarly, in constructing portfolios the keystone to the entire process is gaining an understanding of clients needs. This is more than determining retirement horizons and income projections, but rather goes deep and broad through many ongoing conversations to understand the often unspoken and emotional drivers that influence the client’s relationship with money. It is our belief that while money is just a tool, it represents profound power that is both coveted and loathed. Helping our clients uncover their hidden or latent emotions and experiences with money uncovers needs and wants that many would not have discovered otherwise. As is often coined, “any problem well understood is 90% solved,” sufficient time spent in the first step will make the subsequent steps much more remedial, though no less important. Whether it is constructing portfolio scenarios with an eye toward risk or diving into the weeds of a business asset in facilitating strategy and coaching business leadership; it is through the integration of disparate disciplines where advisors can provide the most benefit. This is where Pilot Wealth distinguishes its core value proposition.

The truth is most portfolios are not prepared for risk because as Gertie has taught us, the most dangerous risks are the ones over-confidence are blind to. And as we are observing in the markets now, many of the painful lessons from the Great Recession have been forgotten and investors on the whole are continuing to believe as if they are immune from the risks of outside forces. A victim is created in the process.

“There are old investors and there are bold investors, but there are no old bold investors.” – Howard Marks

Ego aside, we admit that this is a nuanced and complex world. There are simple disciplines, when in tandem, become compounded and when left to chance can be devastating, just as physics, material sciences, geology, weather (and many others), are to bridge building. Charlie Munger has said, “Investing is not easy, anyone who says it is, is dumb.” A successful investor must bring a multi-disciplinary approach. Understanding, not just knowledge that: economic cycles, human behavior tendencies, efficient markets (and its limitations), interest rates, value, the relationship between price and value, and circle of competence; are all critical. In market terms, to describe these forces as interconnected would be an understatement.

It is highly likely that application of the Systems Engineering discipline would have revealed the now obvious design flaw overlooked by the designers of the Tacoma Narrows bridge…too late for Tubby the Cocker Spaniel.

A major limitation many of us have as human beings is our sequential, event based observations. In other words, for every effect there is a cause. We may, for example, say that the financial crisis was caused by greed among Wall Street investment bankers. As we now know this is only a small part of the story as the collapse was accelerated by investor’s willingness to pay high prices for homes, inadequate sub-prime mortgage underwriting by banks, the repeal of the Glass-Steagal Act, and interest rates being too low for too long. All of which conspired together in a feedback loop resulting in no one single cause, but rather an inter-connected system of forces that in combination, created the economic collapse.

We must recognize that financial markets are complex systems. They are composed of inter-connected parts and the connections cause one part to affect another, which affects the entire system. The structure of the system, or the pattern of connectedness is 1000 times more important than the individual parts of the system, as the structure determines its behavior, and feedback loops control the overall behavior of the system. A feedback loop occurs when the output from one part of the system loops around to influence the input of the same part.

One feedback loop we have discussed previously is the loop created as a result of Federal Reserve intervention. Lower rates have encouraged investors to take more risk in their portfolios in order to earn a respectable return. This impacted the oil industry in a separate feedback loop that led to US oil producers over producing and creating a sudden fall outside of the apparent stability of the recent past. Undoubtedly there are other feedback loops that have been created with the ongoing Federal Reserve intervention. Understanding of these systems leaves a prudent investor no choice but to maintain an adequate level of liquidity (cash and short-term low risk fixed income) and to pursue select, well-evaluated opportunities with extreme caution.

In spite of the collective wisdom in the financial markets, proverbial bridges will continue to fall and as risk managers, we remain vigilant in ensuring rigor and higher level thinking in how we proceed on our client’s behalf. Our prime objective is to ensure that the bridge to the future is sound and built to withstand the vagaries of an uncertain world.