The double digit stock market returns we experienced in the first quarter should give us a reason to pause. Being 48 months removed from the financial crisis, we feel investors have developed unrealistic expectations for future returns, which will ultimately lead to disappointment. Given the prospects for future gains, we should expect that dividends will make up more than 50% of domestic stock market returns over the next 10 years. Meanwhile, bonds are underappreciated by investors. This is due to the expectation of rising interest rates. In our view, investors have forgotten the benefits of the liquidity and diversification that bonds offer. Lastly, as has occurred in Cyprus recently, when small and largely inconsequential events occur to the detriment of a few, it should serve as a sober reminder of the risks we regularly face as investors, especially when risks are largely ignored.

Market Return Expectations

In light of the US stock market’s first quarter return, we have seen a flurry of analysts increasing their estimates for stock market returns for the year end 2013. This consistent phenomenon always puzzles me. Their justification contends that the stock market is cheap, according to future earnings expectations. After a 10% gain, the S&P 500 certainly isn’t as cheap as it was at the beginning of the year, yet the analysts are even more bullish.

Analysts are expecting earnings to decline for the first quarter of 2013, with the bulk of the justification for higher stock prices coming from earnings growth at the back half of the year. This, in spite of the fact that analysts have overestimated earnings growth in the fourth quarter of each of the last three years, according to Factset’s recent Earnings Insight Publication.

According to Bespoke Investment Group, the first quarter’s double digit gain (10% on the S&P 500) has occurred only thirteen times since 1928. Returns for the rest of the year, during those thirteen years, averaged a mere 1.4%. Hardly reason to increase market estimates.

Instead of speculating on earnings growth in the short-term, we prefer to look at long-term trends. These trends, which have proven to be much more reliable over the years, are pointing to lower earnings growth and market returns.

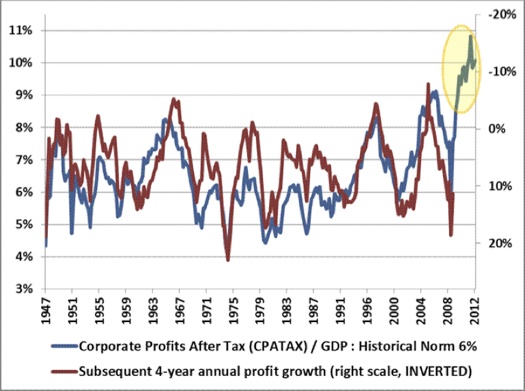

The following chart (from John Hussmann) shows a very high correlation and predictability of earnings growth as a percentage of our overall economic growth measured by GDP. With a historic norm of 6%, corporate profits are considerably above their mean. A reversion to this mean would indicate much slower earnings growth in the future.

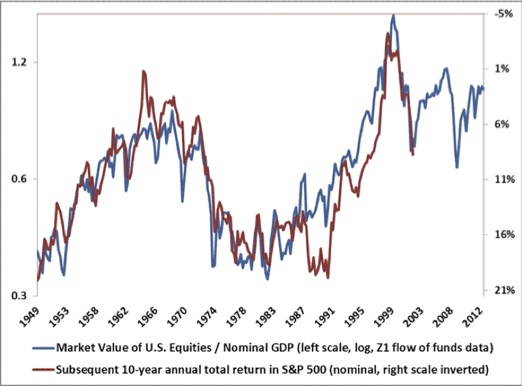

Earnings growth alone is only one of two significant variables to consider when analyzing market returns. Valuations have long been considered an equally important variable to consider for prospective ten year returns. Unfortunately, when you compare market valuations to overall GDP (also very highly correlated over ten year periods) it tells a similar story. We should not expect double digit returns consistently in the future.

In our view analysts and investors have become way too optimistic and are forgetting the risks inherent with investing in the stock market. Relying too heavily on a consistently rising, double digit return stock market can have devastating consequences to portfolios. Let’s not forget that markets go down. In our view, early in the 1st quarter, we began to prematurely recognize future stock market returns. The consequences of this will be slower growth over the coming 5-7 years and potentially, a significant correction.

Dividends have made up nearly 50% of total return (since 1929). We see a higher probability of dividends making up significantly more than 50% of equity returns in the future. In light of the likelihood of slower earnings growth and consequently single digit market returns, we see dividends as an essential component of long-term investment portfolios.

Investment Themes: Leading Large Cap Tech Is On Sale

Many large cap technology companies currently offer a strong and growing dividend yield that is quite intriguing. Microsoft, Intel, and Apple are among the most underappreciated companies. Similar to Pharmaceuticals in 2010 and 2011, there are many reasons to avoid these leading companies. Often times when negative sentiment builds, the market swings too far and severely discounts these underappreciated franchises.

Spotlight on Apple

It seems like yesterday when Apple could do no wrong and it was the darling everyone had to own. Oh how times change! When a company like apple is down 40% from its highs in six months, is sitting on more than 30% of its market value in cash with no long-term debt, it’s worth taking a look. Is sales growth slowing? Yes. Are margins contracting in a very competitive landscape? Yes. Is the iPhone/iPad/iPod franchise dead? No! From a conceptual perspective, in a likely worst case scenario, Apple will collect reasonable cash flow from these franchises until they die. Assuming Apple falls behind the innovation curve, the new latest and greatest technological innovation could come from anywhere. However, it would likely take time to replace Apples’ worldwide marketing capabilities, not to mention it’s die-hard, loyal fan base that will never buy anything but an Apple product, ever. And you get the rest of the Apple business (iTunes, Mac, Apple TV) for free, along with whatever potential new products/businesses that can be developed. With a healthy dividend and significant probable growth in that dividend, it’s worth looking at these depressed levels ($420s as of this writing) for longterm portfolios.

Don’t underestimate the compounded benefit of dividend reinvestment over the long-term. In fact, price volatility will actually be beneficial to a portfolio over time. With Warren Buffett’s recent acquisition of IBM, he was quoted saying that he hoped the stock price was flat or went down over the next few years. This would make IBM’s planned stock buybacks and dividend reinvestment more valuable as its price is more accurately reflected over time.

Inflation and Bonds

We have been hearing quite a lot lately from both small investors and sophisticated investors alike, that inflation is imminent and interest rates are bound to rise in short order and consequently holding bonds is very risky. The reasoning: the fed’s quantitative easing has flooded the market with “cheap money” and this expanded money supply has destroyed the dollar. I was in this camp until early last year, but this simply had not manifested itself in the data.

According to the Quantity Theory of Money (dating back to the 16th century), inflation is not a function of not only the supply or amount of dollars in the economy, but rather the circulation of those dollars (Investopedia). In other words, how rapidly those dollars circulate through the economy. Economists measure this “circulation” through the velocity of money and total transaction volume in the economy. This measure of circulation or velocity has cratered to levels we have not seen since the Fed began records in the late 1950s. This is not a sign of a healthy economy.

With interest rates having crept higher, many have completely abandoned the value of bonds in a diversified portfolio. With the current risks we face, we look at bonds as a reasonable holding place for short-term monies. For those with cash flow needs, bonds are a liquidity tool on the short end of the yield curve. For those with a long-term time horizon, bonds are a risk management tool, not to be held into perpetuity, but to provide some insurance should/when we experience an inevitable correction/calamity. To ignore bonds in favor of equities, because of interest rate risk alone, is foolish.

Is Cyprus Important

Many would argue that Cyprus is such a small country and it is so inconsequential that we should not care. I agree that it is a relatively small economy and it doesn’t make much of a difference in the global economy. But, the event itself is important. It could provide valuable insight and a roadmap on how the European Central Bank officials and European politicians view a solution to the ongoing insolvency among European banks. The fact is that some of the largest European banks are still leveraged as much as 60:1. Overly leveraged banks in the US have been recapitalized and for the most part are now functioning independently. We have all heard the term “too big to fail,” but we are now faced with the question, are European banks “too big to be bailed out?”

We have been discussing the European issues for some time now and it is becoming painfully obvious that European politicians refuse to recognize the real issues of over indebtedness. Unfortunately, those officials are going to be schooled in Irving Fisher’s Debt Deflation Theory. In the long-term, I worry about political unrest and depression in Europe. Some have begun to point out that the divisive language and undertones of nationalism are reminiscent of ghosts that we have spent the majority of this last century trying to forget (Michael Ivanovitch, MSI Global). As mentioned in previous quarters, the European crisis has had relatively small impact outside of Europe for the time being. But out of all the countries outside of Europe, the emerging market economies are bearing the brunt of these issues.

It is not our intention to be cavalier about this topic—the impacts of destabilizing events can cause great harm to people that can last generations. We would not wish this for any society. History, is a great teacher however, and as rational investors we must remember, where uncertainty and fear exist, investment opportunities are not far behind. The emerging market economies still have an insatiable thirst for capital and we must be observant to when and where the opportunities are to participate while maintaining the ethics and values of who we are as a firm as we accomplish the long-term investment objectives of our clients.