With the Fed meeting later this week and the prospect of continued tapering of asset purchases, it is a good time to revisit the theory behind Quantitative Easing. In this extended discussion, we look at the impact of QE, the hope of what it will induce, and how we are planning for the uncertainty. We refer back to our 2013 Q3 Commentary and the capital markets line in the proverbial quest of answering the question of "what do we want to own?"

2014 Q1 Commentary: A Bird in the Hand is Worth...

We have written in last quarter’s report that we should expect lower annual market returns than what were achieved in the previous 4 years. The reason for this has less to do with a change in the vigor, (or lack thereof) with which our economy grows and more to do with the price paid for assets in today’s environment. To explain let’s first review the rationale of any capital allocation decision and finish with discussing the significance of volatility and the need for unconventional thinking. The basis of any capital allocation decision has not changed since Aesop’s truism in 600 B.C., “a bird in the hand is worth two in the bush.” Warren Buffett, in his letter to shareholders in 2000, added three questions to this enduring axiom: 1) How certain are you that there are indeed birds in the bush? 2) When will they emerge and how many will there be? 3) What is the risk-free interest rate [how would your bird in hand grow without taking any risk]? Of course, in Buffett’s example birds are dollars and a bush is any capital outlay or investment. If you can answer these three questions with certainty, than you will know the maximum value of the bush (investment) and the maximum number of birds (dollars) that should be offered for it.

4/22/14 Chart of the Week: The Game of Earnings Estimates

Earning estimates at the end of Q1 are much different than they were back in January. This week we explore how they have evolved over the last three months. The goal is to provide context for the proverbial headlines of "Company X beat estimates by $0.05 per share" that we are sure to hear.

4/15/14 Chart of the Week: Yesterday's Losers and Today's Winners

The rising tide does not raise all boats. In this week's conversation, Nick Fisher addresses the rotation from last year's losers into Q1's all stars.

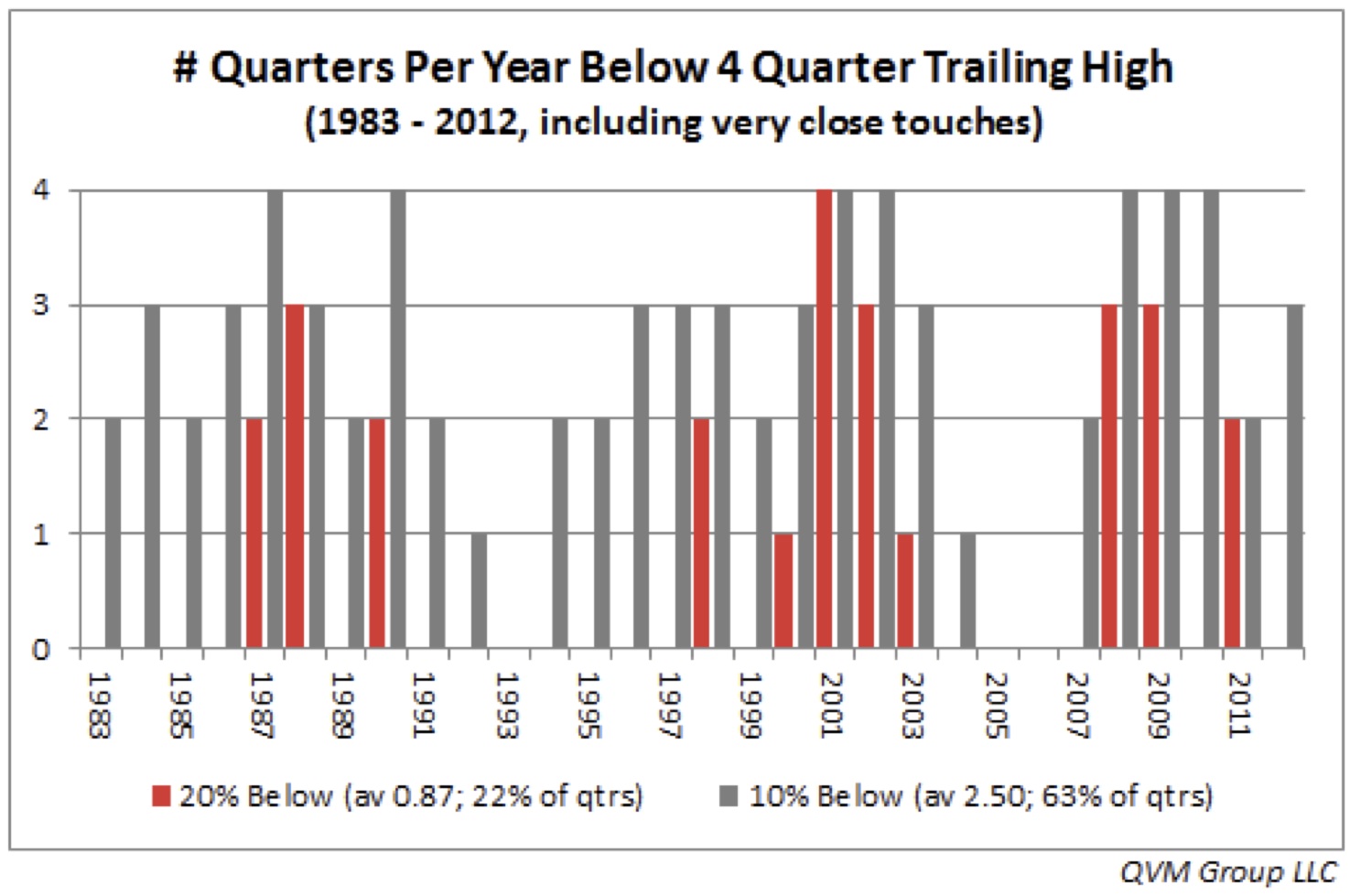

4/8/14 Chart of the Week: Market Volatility

In this week's Chart of the Week, we discuss increased volatility, how often it occurs, and what it means to investors.

4/1/14 Chart of the Week: Valuation Dispersion

In 2000, the market’s PE ratio was nearly double that of 2014. Ironically, there are less companies for sale today at valuations we are comfortable with. Learn more in this Chart of the Week with Pilot's portfolio manager, Nick Fisher.

3/25/14 Chart of the Week: Anatomy of a Bubble

Bubbles have predictable patterns: human emotions can drive asset prices to irrational levels. Understanding this can hopefully help us avoid following the lemmings off a cliff.

3/1/14 Chart of the Week: Supply and Demand - Treasury Maturities & Interest Rate Volatility

Interest rates could be quite volatile as investors digest the Treasury's need to refinance the short term maturities of our national debt.

2013 Q4 Commentary: Investing in Uncharted Territory

“The less prudence with which others conduct their affairs, the more prudence we must use in conducting our own.”

-- Howard Marks’ favorite quote

As a portfolio manager, I have two jobs: 1) Define the playing field by understanding risk and 2) Once the playing field is defined, invest in opportunities that offer our clients the best risk adjusted return in order to achieve their goals. Last quarter we discussed our probabilistic approach in defining the playing field and understanding the dynamic of the risk/return tradeoff. This quarter I will update you on our thoughts on risk and share some thoughts on portfolio construction in light of these risks and uncertainty.

2013 Q3 Commentary: Know Your Limits, It May Be Time To Sober Up

One of the first investing lessons I learned was, not to lose money. Not only is it mathematically a problem, as losing 50% means you must gain 100% to return to even, but it has lasting psychological impact that can cause all sorts of opportunities for misjudgment: pervasive fear that leads to selling at the wrong time, a reluctance to buy at the right time, or buy enough, just to name a few. It is nearly impossible to foretell how we will react, therefore if one is interested in earning a respectable return (greater than the risk free return of short-tem treasuries) we must develop what Howard Marks describes as, “risk Intelligence.” It’s the investors’ job to understand, recognize and control risk. I frequently revisit informative writings in order to ensure that the compass needle is pointing in the right direction. This letter was inspired by an article that Howard Marks wrote some time ago, Risk and Return Today.

“The Fed has spiked the punch bowl. You can get drunk on easy credit and once you do you start doing things drunk people do. We’re not there yet, but we’re a little tipsy. People should start thinking about not driving.” – Howard Marks

2013 Q2 Market Commentary

Having a small farm outside Sherwood and being someone interested in cultivating my green thumb, we planted a few pinot noir vines last year.

In the vineyard, vintners are often at the mercy of the climate and weather. The delicate, thin skinned, Pinot Noir grape, for example, needs a minimum number of growing degree days, but not too much, as raisins make for poor quality wine.

Both the climate (i.e., location of the vineyard), but also the weather in an individual vineyard, are crucial. So it is with investments.

2013 Q1 Market Commentary

The double digit stock market returns we experienced in the first quarter should give us a reason to pause. Being 48 months removed from the financial crisis, we feel investors have developed unrealistic expectations for future returns, which will ultimately lead to disappointment. Given the prospects for future gains, we should expect that dividends will make up more than 50% of domestic stock market returns over the next 10 years. Meanwhile, bonds are underappreciated by investors. This is due to the expectation of rising interest rates. In our view, investors have forgotten the benefits of the liquidity and diversification that bonds offer. Lastly, as has occurred in Cyprus recently, when small and largely inconsequential events occur to the detriment of a few, it should serve as a sober reminder of the risks we regularly face as investors, especially when risks are largely ignored.

Note from Co-Founder & Portfolio Manager

Living outside the hustle and bustle of the city on a small farm has its advantages. Besides making it easier to tire our two active young boys, we are also fortunate enough to have the space to grow plenty of fruits and vegetables to cook with and eat. Farming opens up a whole new world of learning, which is truly my favorite pastime.It is also far removed from the temptations and new trends of Wall Street, an absolute imperative for an independent advisor.

How to Minimize Investment Returns, The Rest of the Story

In the previous posting we discussed the ridiculous layering of fees that has occurred in the investment industry. Just what one is paying for, is often disguised through a lack of transparency, accountability and general knowledge. Most advisors, provide pretty financial plans for a fee, charge an asset management fee, broker the investment making to a third party for still another fee, and then use the financial plan to sell insurance products for, you guessed it, more fees. Despite the inherent potential conflict of interest with this model, I always find it amusing that nearly every advisor I have come across, holds themselves out as, “independent” and “objective.” For reasons that may not be obvious to someone with integrity, the law rightfully doesn’t allow for investment advisors to be compensated solely based on the growth of a client’s assets. With that in mind, it is the customers (unfortunate) responsibility to find an advisor who is truly independent and who’s only compensation is as objective as possible (ie. A fee based only on the assets under management). This contrasts with the conflicted incentives an advisor can receive for selling commission based products.

Fees, Fees, Oh Man Fees!

Transparency, and disclosure are two words that are thrown around a lot, but it has been our experience that it is very difficult to truly understand the fees that an investor pays to work with an investment advisor, money manager or even direct with a mutual fund. This is the first, in a two part series intended to shed light on the investment industry. Warren Buffett (Chairman of Berkshire Hathaway) publishes an annual letter to shareholders where he gives his view of the current investment environment, as well as the operating results of the company he has piloted for the last 40+ years. These letters are archived all the way back to 1977 and are a phenomenal source of insight. The following is an excerpt from the 2005 letter and is an interesting perspective: