Earning estimates at the end of Q1 are much different than they were back in January. This week we explore how they have evolved over the last three months. The goal is to provide context for the proverbial headlines of "Company X beat estimates by $0.05 per share" that we are sure to hear.

Webinar: Getting to Excellence & Growing Your Market Share

Finding your business's sweet spot can be as elusive as a snow leopard or an albino gorilla. Like most leaders, you're on a quest to move your company towards growth and greater success. But how do you best focus your efforts to actually make that happen? In this webinar you'll be challenged to rethink conventional business wisdom and achieve excellence by aligning your passions and talents with market opportunities.

4/15/14 Chart of the Week: Yesterday's Losers and Today's Winners

The rising tide does not raise all boats. In this week's conversation, Nick Fisher addresses the rotation from last year's losers into Q1's all stars.

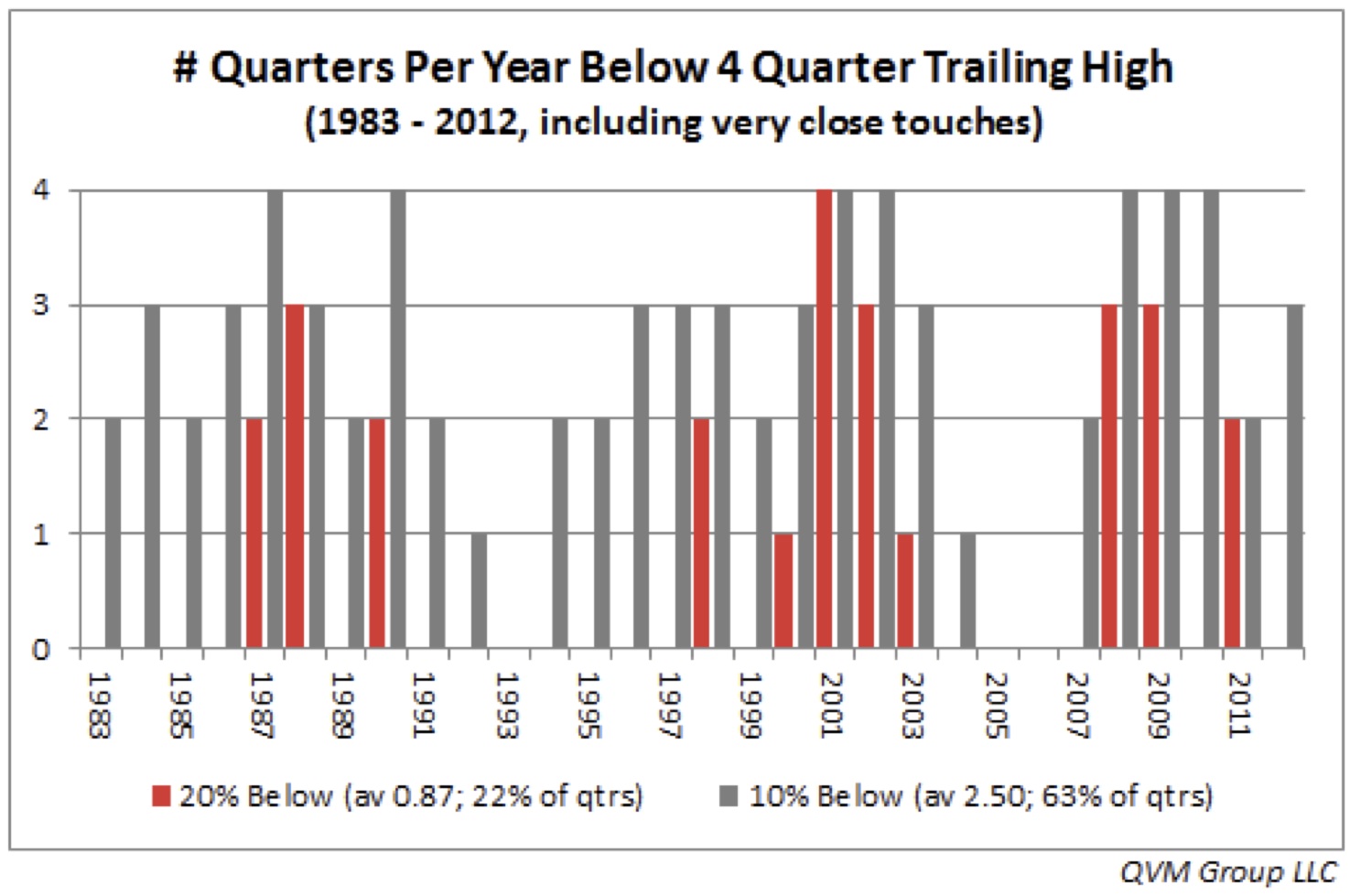

4/8/14 Chart of the Week: Market Volatility

In this week's Chart of the Week, we discuss increased volatility, how often it occurs, and what it means to investors.

4/1/14 Chart of the Week: Valuation Dispersion

In 2000, the market’s PE ratio was nearly double that of 2014. Ironically, there are less companies for sale today at valuations we are comfortable with. Learn more in this Chart of the Week with Pilot's portfolio manager, Nick Fisher.

3/25/14 Chart of the Week: Anatomy of a Bubble

Bubbles have predictable patterns: human emotions can drive asset prices to irrational levels. Understanding this can hopefully help us avoid following the lemmings off a cliff.

3/1/14 Chart of the Week: Supply and Demand - Treasury Maturities & Interest Rate Volatility

Interest rates could be quite volatile as investors digest the Treasury's need to refinance the short term maturities of our national debt.

2013 Q4 Commentary: Investing in Uncharted Territory

“The less prudence with which others conduct their affairs, the more prudence we must use in conducting our own.”

-- Howard Marks’ favorite quote

As a portfolio manager, I have two jobs: 1) Define the playing field by understanding risk and 2) Once the playing field is defined, invest in opportunities that offer our clients the best risk adjusted return in order to achieve their goals. Last quarter we discussed our probabilistic approach in defining the playing field and understanding the dynamic of the risk/return tradeoff. This quarter I will update you on our thoughts on risk and share some thoughts on portfolio construction in light of these risks and uncertainty.

Plan Your Career, Not Just Your Next Job

Unlike our parent’s generation, it is a virtual given that most will face several career transitions in our lifetime. I entered the workforce soon after college in 1986 and have experienced four key career transitions. Knowing these transitions are the norm rather than the exception these days, there was a process I learned after my second transition that proved to be valuable in ensuring I was making good decisions for me and my family-a Council of Advisors. While well known in the business world in the form of a Board of Directors or Board of Advisors, the function is similar-where ideas, inspirations and dreams can be tested and then be held accountable for action. Too often, career decisions are made in haste or in response to short term opportunities and needs, ignoring the long term. The reality is that no matter how good the jobs and opportunities seem to be, a successful career is not built on short term success, but rather over the long haul and more so when continually held against a broader objective of where one is aiming. Whether you find yourself at a transition point in your career, or if you feel your current direction is a dead end and are uncertain which way to go, the following steps can help get the process going:

1. Begin with Why - It is a given when people ask for my advice on career planning, that I will ask them at some point, why? Why that career? To further challenge them, I will clarify that it cannot be about the fortune or fame. If you have not defined your Why, then begin here. A well defined purpose reframes a career trajectory and brings meaningful action to your goals (check out Simon Sinek’s Tek Talk on How Great Leaders Inspire Action. He also has an online course on defining your purpose atwww.startwithwhy.com).

2. Define your council - Whom you invite onto your team may be as important as what you talk about. Your circle of friends is a great place to start, but consider the following qualities when determining whom you will ask:

A. Humility - Simply put, can they put your interests above theirs? Someone who demonstrates humility over ego will keep your interests at the forefront and not feel challenged to “compete” with your desires.

B. Mix it up - The more diversity in perspectives you can bring together, the better. A variety of backgrounds, gender and generation will ensure you are capturing as broad a perspective as possible.

C. Brutal honesty - You must be willing to be held to the often-harsh light of reality. While difficult enough to hear it, it is even more difficult to offer it up to others. Those that are grounded in who they are will be willing to offer the brutal truth.

3. Get a facilitator - Even in the best of circumstances with the right people at the table and a clearly defined purpose, attempting to manage the conversations on your own will create results that are underwhelming and frustrating. A good place to start looking for a facilitator is within the council itself, especially if any of them have experience. Career coaches can also be a good source for facilitation as well. However you find it, make sure you have someone else in the process beside yourself to direct the conversations.

4. Start meeting - Avoid the desire to get things perfect before you meet. Perfectionism is often a stalling tactic. The sooner you start the conversations, the energy around the career planning will be apparent. Frequency for the meetings is somewhat determined by your particular situation, however I would suggest as a starting point to schedule your first couple of meetings within a two months of each other to get continuity and lay the groundwork. Once you begin identifying longer-term objectives, an annual check-in is suitable. You can also call an ad-hoc meeting as situations arise in opportunities or unexpected events and need feedback in the short term.

Lastly, keep in mind that career planning is a marathon, not a sprint. Small, meaningful steps are much more valuable that energetic starts that are not sustained. But more than anything, take action and sooner or later you will learn which direction is right for you.

The Three Legs of an Enduring Business

Screen Shot 2013-12-30 at 11.08.20 AM

While I am an advocate of an annual planning process, there is often a common mistake made with strategic initiatives-they focus too often on the programs and ignore the most important strategy of all-ensuring it has the foundational elements of what builds an enduring business.

Camping with my dad when I was young provided me the framework to understand this. The campsites we stayed at rarely had level surfaces and demonstrating with a portable campstool, my dad showed me how a three-legged stool always finds its level. Sure enough, as I tested the campstool I found that no matter how uneven the ground, it did not rock when I sat on it. The analogy of the three-legged stool has stayed with me over the years and having since experienced the turbulent and often uneven landscape of the free market in the aim of building an enduring business, I have found that it applies here as well.

There are three principles that are crucial to enduring businesses, that when well understood and internalized by the organization, will allow the business to withstand any economic climate. They are as follows:

Purpose - A well-understood and communicated explanation of why the business exists (which by the way, is not about the money), and more important, why it matters, both to the business owner and to the customer. One could even argue that the latter is more important than the former. To underscore this, consider the following: Koch Industries built the largest privately held business in America based on the principle that understanding what creates the greatest value for their customers is the most important thing. The first and most important element of its MBM® (Market Based Management) Framework is, "where and how...the organization can create the most long-term value for customers and society." If it is good enough for Koch in building a $100B+ business, it is good enough to work in our businesses as well. Notice the emphasis on the long-term...something that often is lost in the noise of deal making.

Competence - The business must be great at what it does, and by my definition is the combination of talent, learned skills, and scar tissue from surviving a fire walk-leading the organization through a brush with mortality. To gain competence in your business, you must first be willing to sacrifice for it, be skilled enough to run faster and smarter than the competition, and then have the good fortune of having lived through the fire walk before you truly acquire competence.

Business model - This one is the most fickle of the three. While the first two can endure for the life of a business, the business model may not. Some stand the test of time, many don't. A good model one year can be extinct the next, and often for reasons that are beyond the control of the entrepreneur.

To illustrate this point, I'll draw on an example of a good friend who had opened a retail PC business in his rural hometown about ten years ago. As a savvy engineer and self-proclaimed technology geek, he enjoyed helping people make technology decisions for their personal and business use. The small town he lived in did not have a local PC store or a reliable resource for setting up and troubleshooting home and small business networks. Thus, he opened a retail outlet for both and was soon enjoying a growing patronage. Not long after, a greeting card shop opened next door and he watched curiously to see how long the business would last. As his business continued to build, he began experiencing all the implications of a retail business; warranty returns, damaged product and an occasional fussy customer, the last of which, by his own admission, he was wholly unprepared.

All of this put pressure on the slim operating margins of the PC's that also depreciated quickly on the shelf due to the short lifecycle of the rapidly changing PC technology. Adding to this the hassles of hiring, firing and managing employees, he began to question whether he had it in him to keep it going. As he had also shared, the business was never intended to be end-all, but rather a means to provide a lifestyle he could enjoy while the operation ran largely on its own momentum. It was about that time that he noticed the traffic next door had grown to a steady stream. Staring at his own inventory of expensive computers that were already being discounted, he experienced the proverbial epiphany by 2x4-he didn't have the right business model.

Unlike his PC and service products that were expensive, complex, and prone to failures or repeated service calls, the card shop next door had inexpensive product, virtually non-existent failures, higher margin and long shelf life.

"I finally had to admit that no matter how well the business was managed," he said soberly, "if I don't have the right model, I'll never get to where I want to go. And I didn't have it."

As he realized, defining the right strategy for your business must include an assessment of your business model, under harsh light of what Jim Collins (Built to Last, Good to Great) calls, "the brutal facts of reality." If you do not have the right business model, you must come to terms with that. No amount of wishing or good intentions, or IT initiatives will change the reality of that situation. My friend sold his business within six months of realizing what was missing in his strategy.

Best understood by performing a Strategic Alignment Assessment, there are some questions, however, that can be answered to begin understanding whether your business has these three foundational elements: 1) Do you or your organization understand what it is passionate about? Do your customers know it? Why does it matter? Again, this is not about how much money the business is making. 2) Is the business good at what it does? Has it defined its Circle of Excellence? Has it learned to say no, to focus on what it can say yes to? Has it experienced a do-or-die moment and lived to tell about it? 3) Does the business accelerate with scaling? Are the margins defendable? What is the strength of its position between the supply and demand? Does it have high capital requirements? A Porter's Five Forces analysis can also be very helpful here.

However you or your organization arrives there, the combination of the three foundational principles will ensure you are building an enduring business to stand the test of time.

Is Your Business Currently Worthy of Your Investment?

An annual ritual in corporate America happens each year when leaders of publicly traded companies summarize their reflections on the prior year, and outline plans for the coming year. Preceding the annual report, their letter is published for current and would be shareholders to review, and subsequently judge the merits of owning shares in the company. What if you had to write a letter to shareholders discussing the merits of owning shares in your business? Doing so may be the MOST important thing you do for your business in 2014.

On a basic level, a letter should include the following:

Remind shareholders why you exist

Review the strategy for the last 5 yrs

Explain & Reconcile the key outcomes

Outline the strategy for the next 5 yrs

The process begins with self-awareness. It may be the most critical component in understanding where you are, and therefore where you are going. I am reminded of a current client who had a "successful" distribution business. The only problem was that he didn't seem to be making progress. He considered hiring a CFO to help understand what was going on financially. He agreed instead to a facilitated assessment in which we engaged in a critical look at both his and the businesses short-comings. The assessment revealed not only a lack of financial awareness but also a lack of understanding of who controlled the value chain within his industry. As a result, he initiated a multi-year strategy focusing on how to leverage his strengths in these areas. The outcome of this strategy will nearly double his profit margins, and secure his long-term sustainability. His strategy included: a) proactively managing and gaining more control over his supply-chain, b) recapitalizing his company to reduce the risk of an economic downturn, while becoming less dependent on debt financing and c) focusing on his most important financial metrics, rather than the "cool" projects to promote his company.

A long-term view is significant as it is too easy to focus on the short-term, while sacrificing long-term sustainability and investment in the future. Most small and middle market companies have thought very little about their strategy. Most are opportunists, where they see a customer need and attempt to meet that need, taking on projects to build systems around their product or service. While this is how most companies are created, a more intentional and sophisticated strategy is critical to building a sustainable and valuable company. Consider IBM's strategy from their 2012 Letter to Shareholders:

IBM's Model: Continuous Transformation

In an industry characterized by a relentless cycle of innovation and commoditization, one model for success is that of the commodity player - winning through low price, efficiency and economies of scale. Ours is a different choice: the path of innovation, reinvention and shift to higher value.

If you understand your industry, your company's current position and resources, then you can plot a course going forward. In IBM's case, they have elected to deemphasize slow growing, low margin business sectors, like their hardware business which was formerly a huge component of their total business. Instead, IBM chooses to focus on the higher growth and higher margin business segments. An objective look at your business is critical. Often times a board of advisors, mentors and/or outside consultants can assist best with this assessment.

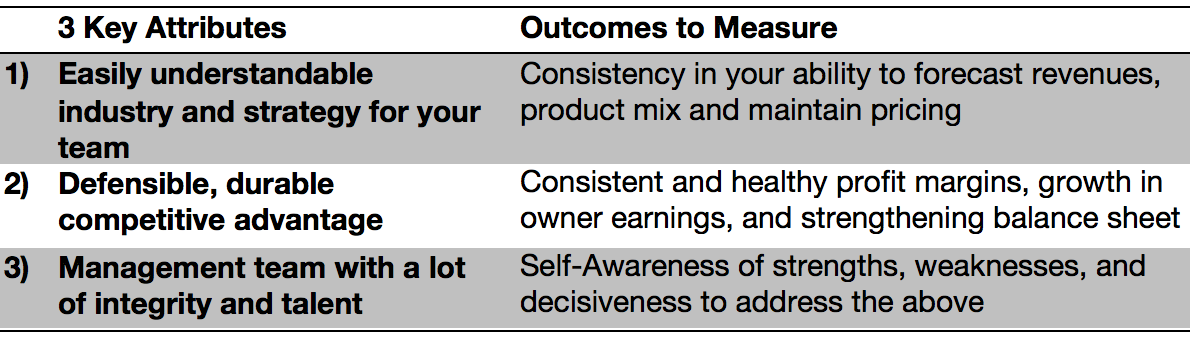

Understanding what outcomes to measure is vital. In our view there are three key attributes and outcomes that make a great company:

Screen Shot 2013-12-30 at 11.01.36 AM

The process of constructing a letter to your shareholders can be a very useful exercise. A well crafted letter should include a summary of all the information needed to evaluate the investment in a business. It should allow an outsider to determine the value of your business. If you cannot articulate this, your business may not be worthy of investment. Remember, we are investing considerable time and money in our businesses on a daily basis. Is your business worthy of this investment? Whether or not you intend sell your stake in your business or use it as a tool to build wealth, answering this question on an annual basis is imperative to reaching your goals.

2013 Q3 Commentary: Know Your Limits, It May Be Time To Sober Up

One of the first investing lessons I learned was, not to lose money. Not only is it mathematically a problem, as losing 50% means you must gain 100% to return to even, but it has lasting psychological impact that can cause all sorts of opportunities for misjudgment: pervasive fear that leads to selling at the wrong time, a reluctance to buy at the right time, or buy enough, just to name a few. It is nearly impossible to foretell how we will react, therefore if one is interested in earning a respectable return (greater than the risk free return of short-tem treasuries) we must develop what Howard Marks describes as, “risk Intelligence.” It’s the investors’ job to understand, recognize and control risk. I frequently revisit informative writings in order to ensure that the compass needle is pointing in the right direction. This letter was inspired by an article that Howard Marks wrote some time ago, Risk and Return Today.

“The Fed has spiked the punch bowl. You can get drunk on easy credit and once you do you start doing things drunk people do. We’re not there yet, but we’re a little tipsy. People should start thinking about not driving.” – Howard Marks

Family Council Begins With Conversation

When I was a kid I used to love Sunday afternoons. My parents would take us out to eat after church, usually at Chace’s Pancake Corral in Bellevue, WA. I would stuff myself silly with strawberry waffles and then go bowling or some other family activity for the rest of the afternoon.

Life was good and I figured that was how it was always going to be, until one weekend when my parents decided we needed to start having family meetings.

2013 Q2 Market Commentary

Having a small farm outside Sherwood and being someone interested in cultivating my green thumb, we planted a few pinot noir vines last year.

In the vineyard, vintners are often at the mercy of the climate and weather. The delicate, thin skinned, Pinot Noir grape, for example, needs a minimum number of growing degree days, but not too much, as raisins make for poor quality wine.

Both the climate (i.e., location of the vineyard), but also the weather in an individual vineyard, are crucial. So it is with investments.

Managing The Gap

“You were wrong,” Phil stated confidently. “How so?” I asked, though I could tell where the conversation was going. I had worked with Phil and his team several years ago. With a couple dozen employees and ten million in sales, we implemented a strategic alignment of the business; a process of creating the foundational vision, mission and values along with the strategic processes to achieve the business objectives.

“Our growth," he continued. "We are achieving what we set out to do, but it hasn’t happened like you said it would.”

I don’t ever recall telling him how it would happen, but I wasn’t going to argue the point.

“When we put our plan together for how we would get there, we calculated it would take a double digit growth rate, year over year. We were on track the first couple of years, then the economy dumped and our sales went flat. Then we had a down year. We all took a pay cut to avoid laying off anyone.”

“Good for you Phil. Sounds like to you did the right thing.”

“Yeah, but my point is the goals and metrics became so unbelievable that I finally stopped sharing them. They became meaningless.”

It was at this point that it took everything in my power to keep from telling Phil this is where he missed the opportunity—in managing the gap between the goal and the current performance.

“So, what did you do?”

“I told them to just focus on their job and I’ll worry about where the business is going.”

Phil’s reaction is an all too familiar refrain I hear from many businesses owners. When things are going as planned managing the business is easy. The truth is however, we are learning much less when business is going as planned than when it isn’t. It’s not easy to do, especially when everyone is looking to you for answers. Rather than bailing on the process as Phil did however, there are some simple steps you can take to stay the course, as follows:

Have a defined goal – As simple as it sounds, many leaders fail to clarify what the target is yet they expect the organization to perform as if they should know, or worse, as if it doesn’t matter. Don’t kid yourself…it matters!

You don’t have to know all the answers – The sooner you stop acting like a problem solver, the better. Become a solution promoter, viewing problems as an opportunity to involve employees in the problem solving process.

Seek small, successive wins – One of the biggest temptations when things aren’t going as planned is to look for big win. While understandable, it is not a recipe for success. Stay the course and seek small but measureable successes. A popular refrain of a friend and sales mentor, Jerry Vieira of QMP Associates is, “succeeding in business comes from doing a thousand small things right.”

Be patient and persistent – Edison once said, “most people don’t realize how close they were to success when they gave up.” You are likely closer to success than you think.

Don’t miss the larger moment – Whether you recognize it or not, you are modeling how to lead through challenging times. How you choose to act today will likely become the standard for the team tomorrow.

Yes, Phil is experiencing success. The larger problem he hasn’t recognized however is it is largely on his back. It is arguable whether the team has learned anything other than to keep their heads down and not ask questions. While it may have worked for Phil this time, he’s done little to prepare for tomorrows challenge. Either Phil can start working with his team to become part of the solution, or he’d better make sure he has his A-game on. It’s not a matter of if the next challenge comes, but when.

Take the time to start working with your team to manage the gap and you will create a foundation for performance that will pay off when it really matters.

2013 Q1 Market Commentary

The double digit stock market returns we experienced in the first quarter should give us a reason to pause. Being 48 months removed from the financial crisis, we feel investors have developed unrealistic expectations for future returns, which will ultimately lead to disappointment. Given the prospects for future gains, we should expect that dividends will make up more than 50% of domestic stock market returns over the next 10 years. Meanwhile, bonds are underappreciated by investors. This is due to the expectation of rising interest rates. In our view, investors have forgotten the benefits of the liquidity and diversification that bonds offer. Lastly, as has occurred in Cyprus recently, when small and largely inconsequential events occur to the detriment of a few, it should serve as a sober reminder of the risks we regularly face as investors, especially when risks are largely ignored.

What legacy are you leaving?

American business is at a unique pivot point in history. With the tidal wave of retirements by Baby Boomers upon us, and the influx of Millennials beginning to shadow the doorways of businesses across the country, at no other time in the history of our economy has the potential existed for a transfer of wealth on a scale we have never seen. And yet with all the promise, the daily busyness keeps us from asking the deeper and more profound questions we as business owners should be asking—what legacy are we leaving, and as importantly, to whom? Show me the money According to an Accenture report (Jun,’12), the total wealth that will be transferred by 2045 is in excess of $30 trillion dollars. Further, according to another study by the consulting firm Fair Market Valuations, this wealth consists of 7 million companies, owned by Boomers between the ages of 44 – 62. The Family Firm Institute concludes that only 33% of those companies will successfully transfer their business to the next generation. The implication is 67% of you will not succeed in transferring your business to your kin, and will be left fighting for buyers the open market. Businesses are no different than real estate—when the supply is high, the prices are low.

Under the hood of the demographics Millennials, born between 1983 and 2001 (aka Generation Y), represent the largest demographic wave, (~80M) to enter the workforce since the Baby Boomers (~76M), born between 1944 and 1966. As many of us have experienced, Generation Y is wired very differently than those preceding it. The majority of Gen Y have never known a time when instant access to information has not been at their finger tips, and has created a culture that is demanding, ambitious and creative, yet dismissive of the hallmarks of success highly regarded by their parents. The definition of the American dream is literally being redefined and the influencers are no longer contained within our communities or even this country.

Getting to legacy Within this dichotomy of experiences and values lay both the challenge and the promise of success. I have had the opportunity to facilitate a number of family business successions and the consistent challenge in the process regardless of the industry, size of business or background, is the inability between the exiting and entering generation to define common ground. This “value gap” is further compounded by the myopia on means, namely money and control, versus the vision, values and legacy impact the family wealth will ultimately have. In our family succession engagements, (of which by the way, I do in collaboration with qualified wealth advisors. I have worked with Pilot Wealth Management, www.pilotwm.com, and have found Jason and Nick to be outstanding in their focus on creating value for the client), we focus on the big picture by asking three key questions: What legacy do you want to leave? I love this question because it is the most difficult for business owners to answer (let alone most anyone else!). Yet this is what it’s all about—creating legacy. While the dictionary defines legacy as a gift or inheritance, we like to look at legacy more broadly—the impact the wealth will leave on successive generations. The longer the impact, the greater the legacy. To whom do you want the legacy to benefit? Simply put, this is about being clear in who is being granted the responsibility for stewarding the legacy, and what the frameworks and support mechanisms are required to ensure it sustains. How will the legacy be managed? This is the leap of faith most of you will struggle with. The reality is, unless the incoming generation is given the opportunity to co-create the vision and values, you will never find peace in letting go and allowing them to steward the resources. If you are like most business owners that find all kinds of reasons not to begin these conversations, then put down the smartphone and start asking the questions. You are in a race to see who can preserve and sustain the legacy of your hard fought efforts. Don’t let yourself be left in the cold with the rest of the 67%!

Note from Co-Founder & Portfolio Manager

Living outside the hustle and bustle of the city on a small farm has its advantages. Besides making it easier to tire our two active young boys, we are also fortunate enough to have the space to grow plenty of fruits and vegetables to cook with and eat. Farming opens up a whole new world of learning, which is truly my favorite pastime.It is also far removed from the temptations and new trends of Wall Street, an absolute imperative for an independent advisor.

Note from the Founder

How to Minimize Investment Returns, The Rest of the Story

In the previous posting we discussed the ridiculous layering of fees that has occurred in the investment industry. Just what one is paying for, is often disguised through a lack of transparency, accountability and general knowledge. Most advisors, provide pretty financial plans for a fee, charge an asset management fee, broker the investment making to a third party for still another fee, and then use the financial plan to sell insurance products for, you guessed it, more fees. Despite the inherent potential conflict of interest with this model, I always find it amusing that nearly every advisor I have come across, holds themselves out as, “independent” and “objective.” For reasons that may not be obvious to someone with integrity, the law rightfully doesn’t allow for investment advisors to be compensated solely based on the growth of a client’s assets. With that in mind, it is the customers (unfortunate) responsibility to find an advisor who is truly independent and who’s only compensation is as objective as possible (ie. A fee based only on the assets under management). This contrasts with the conflicted incentives an advisor can receive for selling commission based products.